So it’s John Howard’s fault that Labor can’t balance the budget, because he was running a structural deficit? Well that’s not what the government’s figures, as submitted to the IMF say.

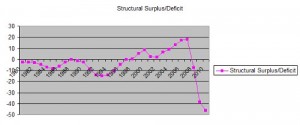

As the graph below shows, since 1980 it has only been during the Howard years that Australia ran a structural surplus at all. And as the graph also shows, the descent after he left office was precipitous. (Thanks to poster Rhian who drew my attention to this on the OLO Forum. The raw stats can be downloaded from here.)

This graph is important because these figures were provided to the IMF long before anyone thought to argue that the structural deficit was the problem. Unfortunately, the argument being run by the official government organs of economic management at the moment is tainted by politics. They have been incompetent and are seeking to cover that incompetence up. Their own figures give the lie to their current position.

No doubt someone will comment on this post that the steep decline was due to the GFC, But if the GFC monies were just once-offs, then why is the IMF registering them as ongoing commitments?

One should also note that this graph disproves the assertion that inheriting a structural deficit condemns one to perpetuate one. Before Howard Australia was in structural deficit, but that didn’t stop him from fixing the situation entirely.

I should also note that Howard has two bites at this graph. He was treasurer in the first part, up to 1983.

The difference in performance between the earlier period, when he was treasurer, and the later, when he was prime minister probably demonstrates three things:

- Prime Ministers make a much larger impact on the economy than treasurers

- Old dogs do learn new tricks, and as PM he applied what he had learned

- You can’t just shrug off the circumstances you inherit

While Kevin Rudd inherited a fantastic fiscal position Howard didn’t – his position had been poisoned by Gough Whitlam.

Which is similar to the position that Tony Abbott will find himself in, inheriting the mess that Rudd/Gillard Labor has left.

It might take a long time before the graph rises above zero again, despite the best efforts of all.

Graham,

You need to read Professor Bill Mitchell’s blog of yesterday’s date.

Howard and Costello balanced their budget by selling public assets,a policy started by those other neo-liberals Hawke and Keating. Instead of the low burden costs of a sovereign government deficit, demand, in the Howard era, was supported by large private citizen deficits in the way of large mortgages and credit card debt.

Repayment of those debts made increased government spending an imperative once the private financial bubble burst.

Neo-liberal policies were responsible for the present need for deficits. Under utilising of underemployed labour and domestic manufacturing resources is still the problem, not the budget.

The IMF is dominated by neo-classical economists. They are persisting in pro-cycle policies when those austerity programs are the opposite of what is required.

The USA, the UK and Southern Europe will not escape the present situation until modern versions of Keynesian policies are adopted.

Comment by John A T — May 24, 2013 @ 8:13 am

Have to agree with John A.T.

Boom and bust cycles are never ever a product of Govt policy, but rather, terms of trade.

Moreover, Howard was the beneficiary of China’s quite spectacular growth. And essentially, that is basically all the graph shows, along with terms of trade.

Howard used the mining boom mark one to write out cheques for folks, who’d never ever been previously entitled, and or, provide tax breaks for folk who didn’t need them.

This done even as the overwhelming bulk of corporate Australia, relocated head office offshore, taking their company tax liabilities with them!

A much smarter option would have been to use the additional revenue provided by mining boom mark one, to create an income earning sovereign fund, which would have allowed us to develop our own remaining offshore resources, rather than leave it to the whim and caprice, of on again off again foreign speculators!

By now, billions could’ve been flowing into and further bulking up our own sovereign wealth fund, which would have made quite a spectacular difference to our budget position, now today!

As would have been the former tax rates he lowered for the much better off, and the roll back of the welfare for the rich, he rolled out while in office!

He also is the dullard, (economic illiterate) who preferred the highly regressive inordinately complex GST.

Which basically transferred the tax burden from the haves to the have nots, who by the way, were already being squeezed by bracket creep!

He could have and should have introduced instead, the transactions tax he refused and erroneously labelled as regressive.

At least that way, some of our tax avoiding guest multinationals, with annual budgets much larger than many sovereign nations, would have not been so easily able to escape paying a fair share of a common burden!

Alan B. Goulding

Comment by Alan B. Goulding — May 24, 2013 @ 10:26 am

The graph does not count asset sales John, so I’m not sure where you are coming from with your complaint about Howard’s privatisations, which anyway were mostly the fulfilment of programs started under Labor.

You’ll also find that Australian private sector debt continues to be quite high. There has been no great unwinding, which puts the lie to the suggestion that the government has to borrow extra to make up for some perceived shortcoming in the private sector.

You’ll also find that a lot of private sector debt is for productive assets, and you can’t say that for government debt at the federal level.

Underlying your post is an assumption that you need borrowing to have growth, but that is not mathematically correct. Debt and equity are just two ways of investing that bring with them different rights. What you need is a system where people with surplus wealth and an inability to use it to generate high returns are married up with people without the wealth but with the opportunity.

It’s the brokerage performed by the financial system that counts most, not how you allocate rights between owners, entrepreneurs and investors.

Comment by Graham — May 24, 2013 @ 3:26 pm

Howard enjoyed exceptional resources sales to China.China is now slowing but in addition to this,China is developing cheaper resources in Africa so prices here will fall.

Unless we start creating our own currency instead of this private debt based creation system,our debt will just worsen and we won’t have such a vibrant mining industry to save us.

Under this present system the value of our exports must far exceed the debt.Very difficult to do since over seas share holdings in our major exporters and banks exceed 30%.

Comment by Ross — May 25, 2013 @ 1:40 pm

The ramp up of China’s “exceptional” resources sales did not happen really until the last term of the Howard government, and the greater part of the Howard/Costello reform agenda was well underway by then.

I think that John, Alan, and Ross have also overlooked the earlier financial crisis that the Howard government lived through, the “asian financial crisis” where Australia was a donor country and offered gaurantees and aid to our neighbours most significantly to Indonesia. This caused damage to exports to some of our major trading partners such as South Korea and Japan and affected both business and Government revenues.

I think it is revisionist, lazy, and plain wrong to blithley give the credit to our trading position with China from 2005 onwards and ignore the record of a fundamentally prudent adminstration.

Good article Graham.

Comment by Chris Lehmann — May 26, 2013 @ 10:07 pm

and….. Alan….. John Howard and Peter Costello did more than any previous administration to address bracket creep and instituted the “rule of thumb” that the greatest majority of taxpayers would pay no more than 30cents in the dollar.

The complexities of the GST which you bemoan, largely came about by having to stitch up a deal with Meg Lees which excluded food, much to Costello’s chagrin. but this reflected his pragmatism and his belief that he’d rather have “80% of something, than 100% of nothing”, politics is after all, the art of the possible.

Comment by Chris Lehmann — May 26, 2013 @ 10:16 pm