I frequently don’t get to watch the 7:00 pm news, but last night I did and was astounded to see Treasury Secretary Ken Henry, looking as arrogant and inflated as the mining bosses his RSPT diminishes, intoning that it does not represent an increase in sovereign risk.

So much for the treasury being independent. I can accept that he might think his resource tax makes sense, but to deny that confiscating 40% of the existing mining industry doesn’t increase sovereign risk, is nonsense.

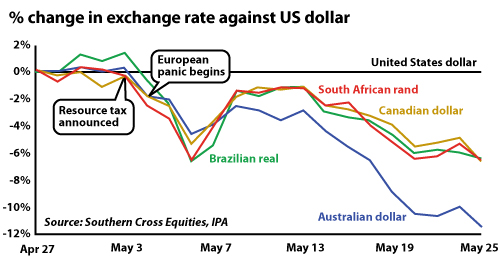

As it so happens, the currency markets provide elegant proof. The graph below was generated by John Roskam of the IPA, and shows just how the Aussie dollar has fared against some of our competitors in the mining industry.

That gap is caused because overseas investors don’t have to own any currency in particular. And one where the government is behaving erratically and public servants don’t appear to have a clue is best avoided.

I think I also heard the Treasury Secretary say that the tax won’t force inflation up. Even if he hasn’t said it, others have. Well, who knows what it will do in the longterm – it might drug the economy to the extent where inflation isn’t a problem, or it might feed through energy and quarrying prices where mining is a national not an international industry – but the ordinary Aussie is going to start feeling it in their back pocket if not this weekend, probably the one after next.

That’s because that 10% dive in the currency is going to feed through into anything we import, and the most pervasive import of all is what goes in the tank in our cars. “Filling her up” is about to become more painful.

A couple of other points arise from Henry’s testimony to the Senate committee hearing.

One is that the RSPT amounts to a progressive tax on mining companies. Some will pay 28% and others, the more successful, will pay 56%. We’ve never had progressive taxation for companies, and we discovered in the 70s what a bad idea a strongly progressive tax system was for individuals. What is his rationale for introducing a steeply progressive tax on just one segment of the economy at this stage?

Another is that this “tax” is being represented as a joint venture arrangement. The government will effectively own 40% of every project because it will rebate costs of setting up a project, so this justifies it earning 40% of the profit. So, unlike normal taxation, where government takes only systemic risk, it will actually share in the risk of each and every project. I don’t think that is in general a good idea, but it raises an interesting constitutional question.

Under the proposal there will be two classes of company – those who start a mine today, and those who already have one. But the government wants its 40% profit from both classes, even though it has no equity and takes no risk in the second class. This would seem to offend against Section 51 (xxxi) of the Commonwealth Constitution which says that the Commonwealth can only acquire property “on just terms”. It also offends against any notion of fairness, constitutional or not.

I’ve heard Ken Henry defended by Labor ministers on the basis that he must be impartial because he was a Howard government appointment. I’d just put him down as one of those mistakes that John Howard made.